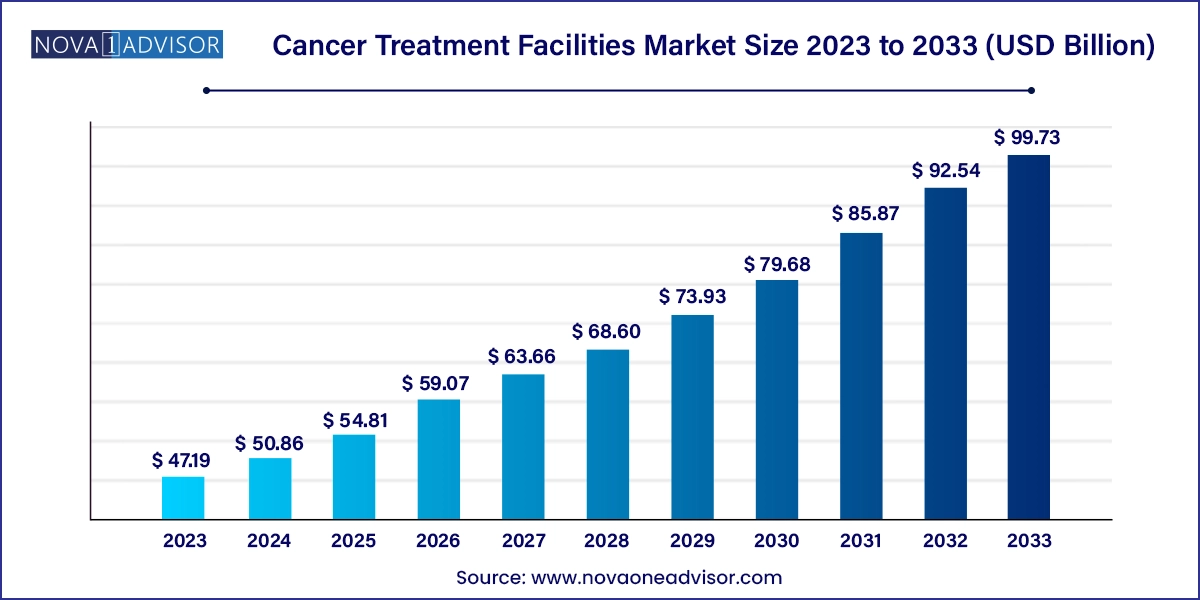

The global cancer treatment facilities market size was valued at USD 47.19 billion in 2023 and is anticipated to reach around USD 99.73 billion by 2033, growing at a CAGR of 7.77% from 2024 to 2033.

Cancer remains one of the most formidable challenges in global healthcare, impacting millions of lives annually and imposing a substantial burden on healthcare systems worldwide. As the incidence of cancer continues to rise due to lifestyle changes, aging populations, and environmental factors, the demand for sophisticated and integrated cancer care has grown immensely. This has catalyzed the expansion of the cancer treatment facilities market, a critical segment of the healthcare infrastructure. These facilities are specialized healthcare centers dedicated to the diagnosis, treatment, and rehabilitation of cancer patients. They encompass a range of services, including surgical oncology, chemotherapy, radiation therapy, immunotherapy, hormone therapy, and bone marrow transplantation.

From standalone cancer centers to multispecialty hospitals and academic institutions offering oncological services, the market includes various providers equipped with advanced diagnostic tools, skilled professionals, and cutting-edge treatment technologies. The increasing investments in oncology infrastructure, government initiatives promoting early detection and treatment, and the integration of artificial intelligence and precision medicine are significantly shaping the market’s trajectory.

Furthermore, healthcare reforms across various countries aimed at universal health coverage and public-private partnerships are improving access to cancer care, especially in developing regions. As the paradigm shifts toward patient-centered and value-based care, cancer treatment facilities are now focusing on not just prolonging life, but enhancing the quality of life through holistic care strategies that include mental health support, palliative care, and personalized therapies.

Rise of Multidisciplinary Cancer Care Models: Increasing collaboration between oncologists, radiologists, surgeons, pathologists, and rehabilitation specialists to provide integrated treatment plans.

Expansion of Outpatient Cancer Centers: Growth of ambulatory oncology centers and outpatient infusion services, improving convenience and cost-effectiveness for patients.

AI and Big Data Integration: Adoption of AI algorithms in radiology and pathology to improve early diagnosis and treatment planning.

Adoption of Precision Oncology: Utilization of genomic profiling and targeted therapies based on individual tumor markers.

Tele-oncology Services: Surge in remote consultation and treatment planning platforms, especially post-pandemic, enhancing accessibility for rural and underserved populations.

Proliferation of Proton Therapy and Robotic Surgeries: High-precision treatments are becoming increasingly popular in developed markets.

Global Initiatives for Cancer Control: WHO’s Global Initiative for Childhood Cancer and similar regional programs are driving facility upgrades and access in low- and middle-income countries.

Emphasis on Survivorship Programs: Focus on long-term survivorship care, rehabilitation, and secondary prevention in cancer centers.

| Report Attribute | Details |

| Market Size in 2024 | USD 50.86 Billion |

| Market Size by 2033 | USD 99.73 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.77% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Treatment, cancer type, provider, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Compass Oncology; American Oncology Institute; Mayo Foundation for Medical Education and Research (MFMER); HCA International Limited; The Royal Marsden; National Cancer Institute at the National Institutes of Health; Apollo Hospitals Enterprise Ltd.; Kokilaben Dhirubhai Ambani Hospital; HEALTHCARE GLOBAL ENTERPRISES LIMITED; The Johns Hopkins Hospital, Tata Memorial Centre. |

A key driver propelling the cancer treatment facilities market is the rising global incidence of cancer. According to WHO, cancer was responsible for nearly 10 million deaths in 2020, and this number is projected to increase significantly over the next few decades. With aging populations and lifestyle factors such as sedentary behavior, smoking, alcohol consumption, and poor dietary habits contributing to this rise, healthcare systems are under immense pressure to develop robust cancer care infrastructure. Countries are responding by expanding cancer centers, improving diagnostic capabilities, and integrating novel treatment modalities like immunotherapy and targeted drugs. The demand for timely and effective care is translating into direct investments in cancer hospitals, outpatient centers, and specialized facilities worldwide.

For instance, the Indian government’s National Cancer Grid and the UK’s Cancer Alliances aim to standardize cancer treatment quality across regions. These developments not only address growing patient volumes but also enhance survival rates through early intervention and consistent care protocols.

One of the most critical restraints in the cancer treatment facilities market is the high cost associated with establishing and operating oncology facilities. Advanced treatment options such as robotic surgeries, proton beam therapy, and CAR-T cell therapy come with significant capital and operational expenses. In addition, the cost of training healthcare professionals, acquiring radiology equipment (like MRI, PET-CT), and complying with regulatory standards adds to the financial burden.

For patients, especially in low- and middle-income countries, the cost of treatment despite insurance support often remains unaffordable. This limits access to advanced care and forces reliance on inadequate or delayed treatment. Furthermore, private investment in cancer infrastructure tends to be concentrated in urban areas, leaving rural regions underserved. Without adequate reimbursement policies and public health funding, achieving equitable cancer care access remains a major hurdle.

An emerging opportunity in the cancer treatment facilities market lies in the growing shift toward personalized cancer therapy, powered by genomics and molecular diagnostics. Traditional chemotherapy and radiation are gradually being supplemented or replaced by therapies tailored to the genetic and molecular profile of individual patients. Facilities that offer genomic testing, biomarker analysis, and pharmacogenomics services are witnessing growing patient volumes and interest from pharmaceutical companies for clinical partnerships.

For example, institutions like Memorial Sloan Kettering Cancer Center (U.S.) and Tata Memorial Centre (India) have integrated next-generation sequencing (NGS) capabilities to support targeted therapy decision-making. This shift is not only enhancing treatment efficacy but also reducing side effects and improving patient satisfaction. As the costs of genetic sequencing drop and regulatory frameworks evolve, the adoption of personalized oncology across cancer treatment facilities is expected to surge.

Chemotherapy dominated the treatment segment due to its widespread use across various cancer types and availability in most cancer care settings. Despite emerging therapies, chemotherapy remains a first-line treatment in multiple oncological protocols, especially in regions where access to newer therapies is limited. It is a core component of treatment for cancers like breast, lung, colorectal, and blood cancers. Many treatment facilities are equipped with outpatient infusion centers dedicated to chemotherapy delivery, boosting its market share. Moreover, the development of oral chemotherapeutics has improved patient compliance and accessibility.

However, immunotherapy is the fastest-growing treatment segment due to the significant advancements in checkpoint inhibitors, CAR-T cell therapies, and monoclonal antibodies. Drugs such as pembrolizumab (Keytruda) and nivolumab (Opdivo) have gained widespread adoption due to their remarkable success in treating advanced melanoma, lung cancer, and other malignancies. Cancer facilities are increasingly integrating immunotherapy units and clinical trial capabilities to cater to this growing demand. As research continues to expand the list of indications, immunotherapy is expected to become a central pillar of modern oncology care

Breast cancer emerged as the dominating cancer type segment in treatment facilities, primarily due to its high prevalence among women globally. It is the most diagnosed cancer in women and one of the leading causes of cancer-related deaths. Comprehensive breast cancer programs including mammography screening, surgery, radiation, and hormone therapy are now a staple in most oncology centers. Major hospitals and cancer facilities, especially in North America and Europe, have specialized breast oncology units that cater to both early and advanced stages.

In contrast, respiratory/lung cancer is the fastest-growing cancer type segment, driven by increasing global incidence related to smoking, air pollution, and occupational hazards. The prognosis for lung cancer has historically been poor, but advances in targeted therapy (EGFR inhibitors) and immunotherapy have improved outcomes, leading to more specialized treatment programs. Lung cancer treatment facilities often incorporate advanced imaging and thoracic surgery infrastructure, positioning them as high-investment, high-return units within cancer hospitals.

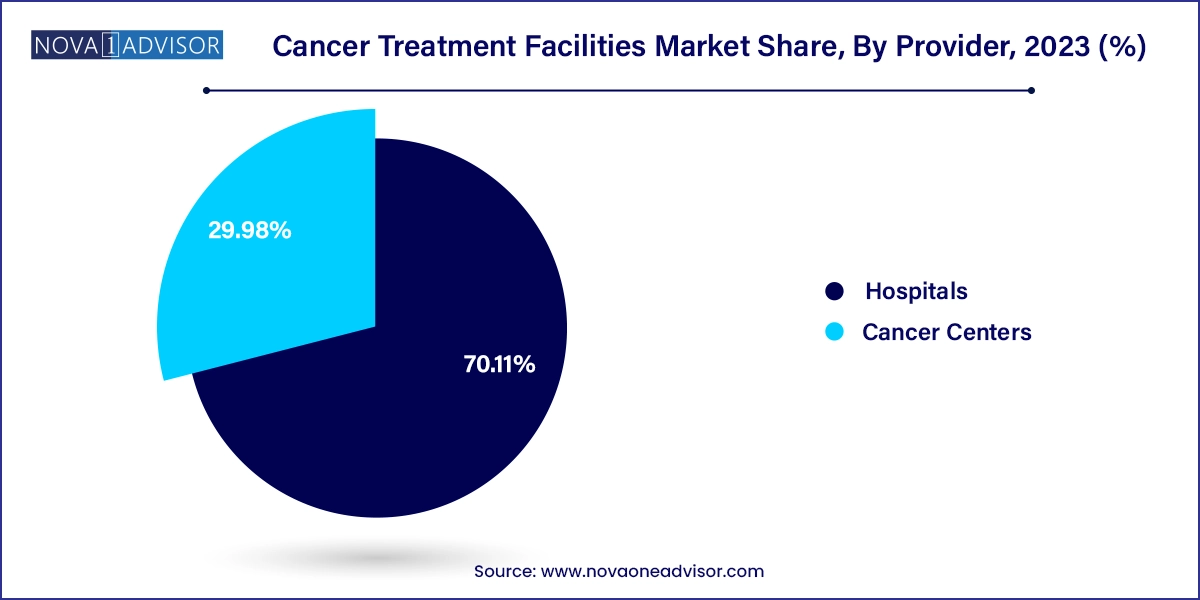

Hospitals currently dominate the provider segment, due to their integrated approach to multi-specialty care and their widespread presence across urban and semi-urban regions. These institutions often house dedicated oncology departments that offer a full suite of diagnostic and treatment services under one roof. Hospitals are also preferred due to their capacity to manage comorbidities and complex surgical cases. Public hospitals in countries like Canada, Germany, and Japan are heavily involved in oncology services, supported by national healthcare programs.

Conversely, cancer centers are the fastest-growing providers owing to their exclusive focus on oncology care. These facilities are equipped with specialized staff, research labs, and comprehensive cancer management units that allow them to cater to both common and rare cancers. Notable examples include MD Anderson Cancer Center (U.S.) and Gustave Roussy (France). Their ability to conduct clinical trials, offer novel treatments, and deliver personalized care makes them a preferred destination for advanced treatment, thus driving their growth trajectory.

North America leads the cancer treatment facilities market, attributed to its advanced healthcare infrastructure, high cancer prevalence, and significant investment in oncology research. The U.S., in particular, houses some of the world’s top cancer centers like Dana-Farber, Mayo Clinic, and Memorial Sloan Kettering, offering comprehensive care across all stages of the disease. Federal funding through NIH, NCI, and Medicare reimbursements, coupled with high health awareness and insurance coverage, have enabled early diagnosis and wide accessibility to treatment options including proton therapy and immunotherapies.

Moreover, strategic collaborations between healthcare providers, research institutions, and biotech firms have spurred innovation in treatment modalities. Telemedicine initiatives and survivorship programs have also enhanced the patient experience in the region.

Asia-Pacific is the fastest-growing region in the cancer treatment facilities market, driven by rapidly increasing cancer burden, population growth, and healthcare infrastructure development. Countries like China, India, and South Korea are investing heavily in building oncology hospitals, diagnostic labs, and mobile screening units. Governments are initiating public-private partnerships to bridge the urban-rural gap in cancer care.

For instance, the Indian government launched the National Cancer Institute and regional cancer centers across states, while China has integrated cancer screening into its national health agenda. In addition, the increasing affordability of medical services and the presence of skilled professionals are attracting international patients, making the region a hub for medical tourism in oncology.

In February 2025, Roche announced the opening of a new personalized cancer diagnostics facility in Basel, Switzerland, aimed at accelerating molecular testing capabilities for oncology centers globally.

In January 2025, Apollo Hospitals Group (India) launched a state-of-the-art proton therapy center in Chennai, the first of its kind in South Asia, further enhancing the company’s position in precision cancer care.

In December 2024, MD Anderson Cancer Center partnered with Pfizer for a five-year joint initiative to conduct clinical trials on next-generation immunotherapies, aiming to improve access to novel treatments for rare cancers.

In November 2024, Siemens Healthineers introduced a new AI-powered diagnostic imaging platform tailored for oncology use, enabling faster and more accurate tumor detection at major cancer centers in Europe.

In October 2024, GenesisCare, an international oncology provider, expanded its operations into the Middle East by establishing a comprehensive cancer center in Dubai, offering western-standard treatment to regional patients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cancer Treatment Facilities market.

By Treatment

By Cancer Type

By Provider

By Region